Industry news may demonstrate you know what's going on in the world.

Your health insurance premiums could start going up in the days to come. Group health insurance policies – offered by employers to their employees and families – have already risen in April, when many such contracts come up for renewal, say experts. According to a Marsh-Mercer benefits survey, employer-sponsored medical benefit costs in India are expected to increase by 15 percent in 2022.

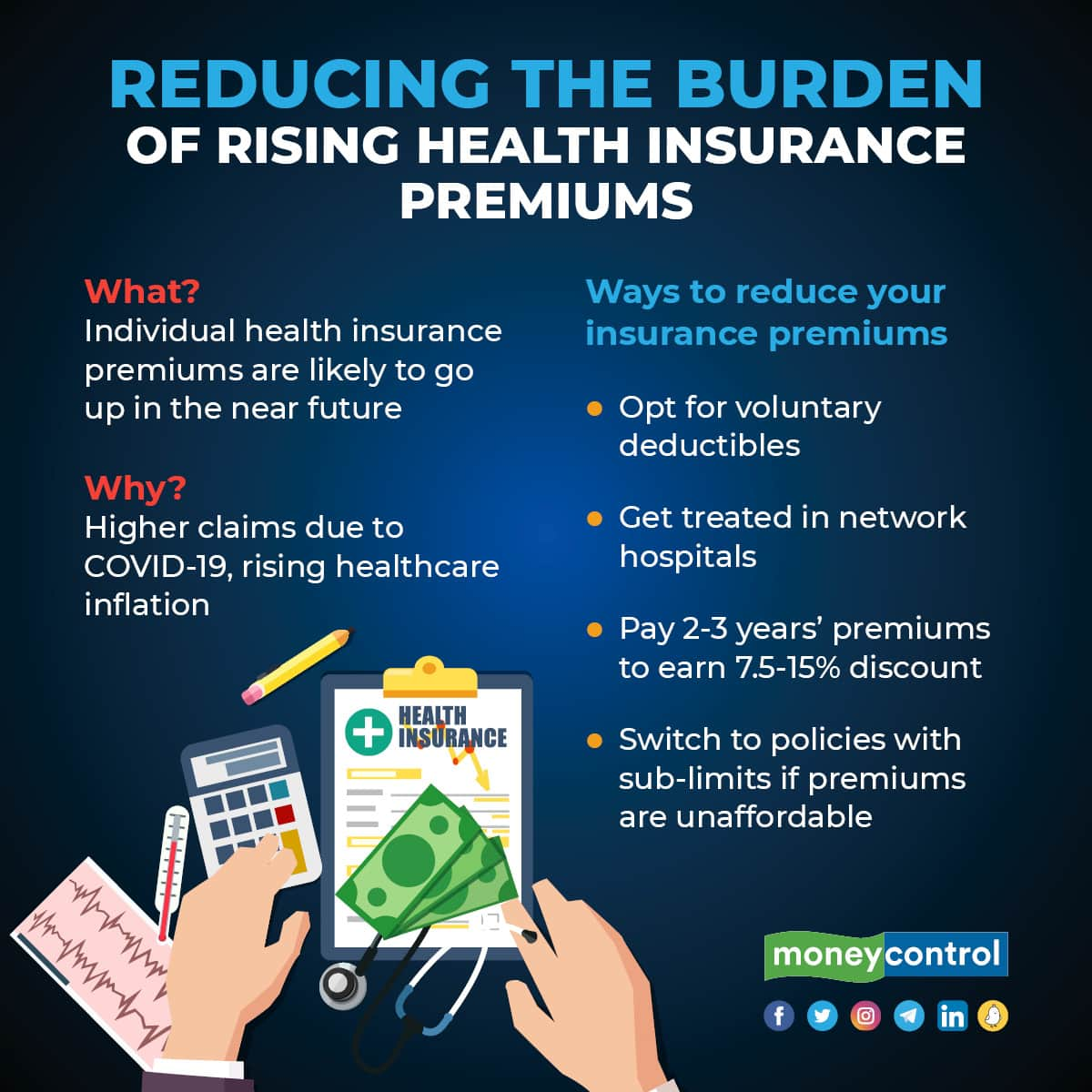

Soon, it could be the turn of your individual policy premiums, as insurers reeling under the COVID-19-linked claim burden and rising healthcare inflation seek the insurance regulator’s nod to hike rates. Industry watchers feel retail health premiums could see an 8-15 percent rise.

Here’s your guide to the causes for these premium hikes and how you can keep a tight lid on them at your end.

Why are health insurance premiums expected to go up in the coming days?

The primary reason is the COVID-19 pandemic, which has wreaked havoc on health and healthcare systems across the world, pushing up health insurance companies’ claims. “Utilisation of health insurance coverage has gone up substantially due to COVID-19-linked hospitalization. In addition, there is a lot of pent-up demand too, as those who had postponed their surgeries and procedures are now filing claims. So, insurance companies are bearing the brunt of higher claims,” says Abhishek Bondia, Co-founder and Principal Officer, SecureNow Insurance Brokers.

He, however, believes that rates will stabilize in a year or two. This apart, health insurance companies can increase their rates every three years based on their claim experience. For policyholders, premiums can also see a sharp spike when they move from one age bracket to another – for instance, depending on the insurer, your premiums could stabilize between 35-39 years, but see a significant jump when you cross 40.

What can I do to contain my renewal premium hikes?

If you are in a younger age group, you have relatively more options to explore. You can compare premiums across insurers and ports to one that offers lower premiums, provided the benefits offered remain the same. “Look for products that are popular and have not seen exorbitant premium hikes over 60-70 percent. Some companies tend to withdraw existing products and move policyholders to other products in their portfolio, but premiums could be much higher.

If you buy popular products that have been around for 2-3 years, the insurer will have less incentive to discontinue the product or hike premiums substantially,” says Shrehith Karkera, Co-founder, of Ditto Insurance.

How should I choose the product I should port to?

Since the exercise would be similar to buying a new policy, the approach should be similar as well. Cheaper premiums than your existing policy apart, look at features, the cashless network of hospitals, claims settlement record, digital support for policy and claim servicing, and so on. “Opt for policies with higher no-claim bonuses. This will allow you access to a higher sum assured, without paying an additional premium,” says Bondia.

This is a useful feature for younger individuals as their chances of making claims are lower. Though this notion did get challenged during the COVID-19 pandemic, particularly the Delta wave in March-June 2021 in India, the fact remains that they are less likely to make claims compared to senior citizens.

I can neither afford my renewal premiums nor the premiums of comparable products from other insurers, but I do not want to let go of this protection cover. What are the options available for me?

In such cases, you might have to settle for products with certain restrictions and watered-down benefits. You can look at porting to health policies that offer voluntary deductibles – a small sun that you agree to pay from your own pocket in case of a claim – that bring down premiums. “For example, if you were to opt for a small deductible of Rs 15,000, your premiums could go down by 15-20 percent,” says Amit Chhabra, Head, Health and Travel Insurance, Policybazaar.com. You can also consider paying premiums for two-three years at one go in return for a discount of 7.5-15 percent. “Some products offer a preferred partner network (of hospitals that offer cashless facilities) discount. Your premiums could be 15 percent lower, but with the limitation that you seek treatment from a select list of hospitals,” says Chhabra. Insurers can afford to offer a discount in such cases as they would have negotiated better (read lower) rates for various procedures.

I am a senior citizen and cannot afford my current plan’s premiums. Can I switch to a cheaper product?

You can, but as in the case of younger individuals, you will have to put up with certain restrictions. “You can look at dedicated senior citizen plans, but only if your current premium is simply unaffordable. In some cases, you may not have a choice but to buy such covers as insurers might not offer regular policies to you,” says Bondia. Senior citizen plans come with room rent sub-limits as well as disease-specific cappings, which dilute the policies’ utility, but at that age, you have fewer options to choose from.

Copyright © 2026 Design and developed by Fintso. All Rights Reserved